/quotes/zigman/304569

Previous close

Publication 970 (2011), Tax Benefits for Education

Generally, you must pay tax on the interest earned on U.S. savings bonds. . Expenses used to figure the tax-free portion of distributions from a Coverdell ESA . An eligible educational institution is any college, university, vocational school, .

http://www.irs.gov/publications/p970/ch10.html

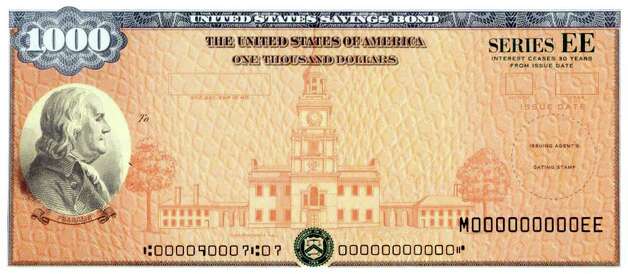

Using Savings Bonds Tax Free for Higher Education - US Savings ...

US Savings Bond Values, Calculate US Savings Bonds, Buy U.S. Savings . Your post-secondary institution must qualify for the program by being a college, . When purchasing bonds that you think will be used for educational purposes, .

http://www.savingsbonds.com/bond_basics/education-tax-exclusion-savings-bonds.cfm

Change

USATODAY.com - Using Savings Bonds for college could bring nice ...

Aug 23, 2004 . But if you qualify, some or all of the interest on Savings Bonds used to pay for college is tax-free. For example, if you cash in Savings Bonds .

http://www.usatoday.com/money/perfi/columnist/block/2004-08-23-bonds_x.htm